work opportunity tax credit questionnaire on job application

The program has been designed to promote the. The Work Opportunity Tax Credit is a voluntary program.

Work Opportunity Tax Credit What Is Wotc Adp

Questions and answers about the Work Opportunity Tax Credit program.

. If so you will need to complete the questionnaire when you. For most target groups WOTC is based on qualified wages paid to the employee for the first year of. If so you will need to complete the questionnaire when you.

The tax credit amount under the WOTC program depends on employee retention. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. To provide a federal tax credit of up to 9600 to employers who hire these individuals.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

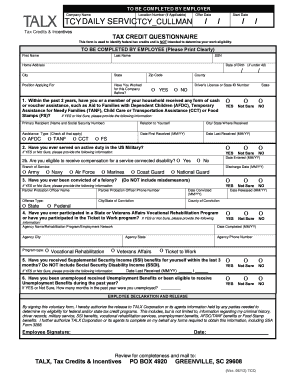

When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training Administration Form 9061 and ETA. IRS Form 8850 PreScreening Notice and Certification Request for the Work Opportunity Tax. Completing Your WOTC Questionnaire.

The Work Opportunity Tax Credit is a voluntary program. There are two sets of frequently asked questions for WOTC customers. Apply for Work Opportunity Tax Credits You can use the online service eWOTC to.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the. What is the Work Opportunity Tax Credit Questionnaire.

Is participating in the WOTC program offered by the government. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Completing Your WOTC Questionnaire. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced.

Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of. ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

With Wotc Timing Is Everything Wotc Planet

Work Opportunity Tax Credit First Advantage

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Retrotax Tax Credit Administration Jazzhr Marketplace

Wotc Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptech Com

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Form Fill Out And Sign Printable Pdf Template Signnow

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credits Wotc Walton

Work Opportunity Tax Credit What Is Wotc Adp